Property taxes?

Will the Government bring in new property taxes – and if so, will these be likely to boost or reduce housebuilding activity and investment?

There is much speculation that the Budget will contain additional property taxes.

Proposals mooted ahead of the Budget are familiar in policy circles – these include occupation based property taxes such as higher 'top sliced' council tax bands and a 'mansion tax' (essentially an annual surcharge bill based on a percentage of the assessed market value of a home); as well as a proposals for higher rate residential property transaction taxes such as removing or restricting the current residential capital gains exemption for higher value properties as well as stamp duty reform.

Changes to existing taxes such as council tax, capital gains tax, stamp duty and inheritance tax are the simplest areas for Government to implement. The Budget could even present limiting residential capital gains tax relief as a form of "wealth tax".

Significant property tax changes might ordinarily be expected to be undertaken in a more buoyant housing market. Such reforms are also administratively challenging and risk distorting housing market activity, as has been seen over the years with stamp duty changes. As such, it remains to be seen how radical any such new proposals may be, how much additional revenue such taxes may raise and the impact on the housing market.

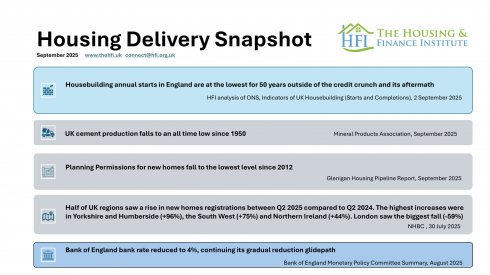

September 2025 Housing Delivery Snapshot

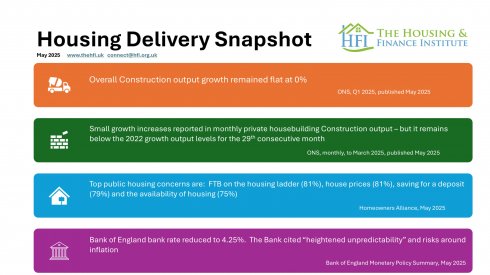

May 2025 Housing Delivery Snapshot

March 2025 Housing Delivery Snapshot

January 2025 Housing Delivery Snapshot

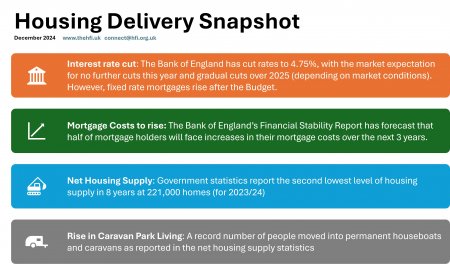

December 2024