27 MAY 2025

Harnessing Local Government Pension Scheme funding for growth

Can we harness Local Government Pension Scheme funding for Delivering Affordable Housing Growth for the Next Decade and Beyond

Adele Gritten, Chief Executive of Local Partnerships and HFI board member sets out the case for change:

Introduction

Affordable housing is more than a social imperative—it is a foundational pillar of economic resilience and inclusive growth. As the UK continues to grapple with a chronic under-supply of genuinely affordable homes, the consequences are becoming increasingly visible: rising homelessness, deepening social inequality, and mounting pressure on public services. These challenges not only affect the most vulnerable but also hinder local economic development and community cohesion.

To address this crisis, a multifaceted and forward-thinking approach is essential. One of the most promising avenues lies in leveraging the financial strength and long-term investment horizon of the Local Government Pension Scheme (LGPS). With strategic planning, collaborative partnerships, and targeted investment, we can unlock a new era of affordable housing delivery that is both scalable and sustainable.

The Economic and Social Imperative

The lack of affordable housing is not a standalone issue—it is a systemic challenge with ripple effects across society. When families are priced out of stable housing, it affects their health, education, and employment prospects. It also places additional strain on local authorities, healthcare systems, and social services.

Moreover, the housing crisis stifles economic mobility and productivity. Workers are forced to live further from their jobs, increasing commuting times and reducing quality of life. Businesses struggle to attract and retain talent in high-cost areas. In this context, affordable housing becomes not just a moral obligation but a strategic economic investment.

The Role of LGPS in Driving Change

The LGPS, with its substantial pool of assets and long-term investment outlook, is uniquely positioned to be a catalyst for change. By investing in affordable housing, LGPS funds can achieve stable, inflation-linked returns while fulfilling their fiduciary responsibilities. This alignment of financial and social objectives makes affordable housing an ideal asset class for pension schemes.

A recent Localis/Local Partnership/Isio Report highlights how LGPS investments can be channelled into housing projects that not only meet return expectations but also contribute to the government's broader growth agenda. This dual benefit—financial sustainability and social impact—makes LGPS a powerful vehicle for addressing the housing crisis.

Strategic Recommendations for Scalable Impact

To fully harness the potential of LGPS and other stakeholders, several strategic actions are recommended in the research paper:

1. Reclassify Social Housing as National Infrastructure

Reframing social housing as critical national infrastructure could unlock significant capital investment. This reclassification would elevate housing to the same level of strategic importance as transport or energy, making it eligible for broader funding streams and policy support.

2. Mandate Revenue Contributions

A portion of the savings could be mandated as revenue contributions to capital expenditure. This approach ensures that financial efficiencies are reinvested into long-term community assets, creating a virtuous cycle of growth and reinvestment.

3. Secure Long-Term Financing for Capital Backlogs

Local authority Housing Revenue Accounts (HRAs) and housing associations face significant capital backlogs. Long-term financing arrangements are now essential to address these deficits and enable the development of new, high-quality affordable homes.

4. Foster Joint Ventures and Innovative Partnerships

Collaboration is key. Joint ventures between local authorities, housing associations, LGPS pools, and private sector partners can distribute risk, pool expertise, and accelerate delivery. These partnerships must be built on shared goals, transparent governance, and mutual benefit.

5. Invest in Capacity Building

Delivering housing at scale requires skilled professionals and robust institutional capacity. Investing in the capabilities of local authorities—through training, strategic support, and technical advisory—will ensure that projects are delivered efficiently and effectively.

6. Develop Credible and Scalable Pipelines

A consistent pipeline of investable projects is essential to attract and retain capital. These pipelines must align with local growth plans and spatial strategies, ensuring that developments meet both community needs and investor criteria. Unlocking stalled sites and repurposing underutilised land can also play a critical role.

Examples of innovation and delivery

A recent standout example of innovation in this space is the Welsh Government's £24 million Land for Housing loan fund, designed to unlock land for both social and market housing development. This initiative enabled early-stage land acquisition before construction grants were available, ensuring that viable projects are not delayed due to funding gaps. Once construction funding is secured, loans are repaid and reinvested into future developments—creating a sustainable cycle of housing delivery.

Similarly, the Wales & West Housing development in Grangetown, Cardiff, saw a £3 million land acquisition loan followed by £10 million in grant funding to build 100 affordable homes. The project not only delivered high-quality family housing near the city centre but also fostered a vibrant community with excellent access to amenities.

Then there's Phoenix Group's recent investment into affordable housing, advised by Eversheds Sutherland. The deal showcased how legal and financial structuring can unlock new models of investment that are both commercially viable and socially beneficial. Phoenix Group is helping to create a replicable model for other institutional investors seeking to enter the affordable housing space. The scheme sees the upgrading of poor quality housing stock using a long term credit tenant lease financing structure with a final repurchase option. The housing stock is being transferred from a housing association to a local council and, once upgraded, will assist with meeting temporary accommodation needs.

A Call to Action

Now, more than ever before, we need a clarion call to action for all stakeholders—government, pension funds, local authorities, housing associations, and the private sector—to come together in pursuit of a shared vision delivered at pace: a future where everyone has access to safe, affordable housing.

This vision is not only achievable but also essential for the long-term prosperity of our communities. By leveraging the financial strength of LGPS, fostering innovative partnerships, and investing in local capacity, we can build a housing system that is resilient, inclusive, and fit for the future.

Conclusion

Delivering affordable housing growth over the next decade and beyond requires more than policy ambition—it demands practical, coordinated action with each actor knowing and understanding the role they play in the chain. The LGPS offers a unique opportunity to align financial returns with social impact, while organisations like Local Partnerships providing the expertise and support needed to turn vision into reality.

As we look ahead, the path is clear: collaborate, innovate, and invest. By doing so, we can create a housing landscape that supports economic growth, strengthens communities, and ensures that everyone—regardless of income—has a place to call home.

Find out more about the work of Local Partnerships here: Our Purpose

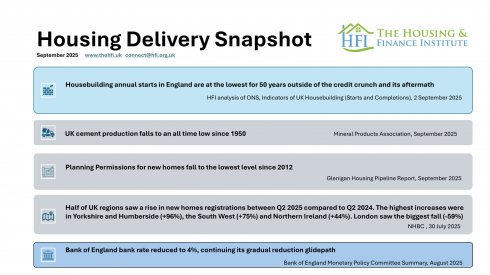

September 2025 Housing Delivery Snapshot

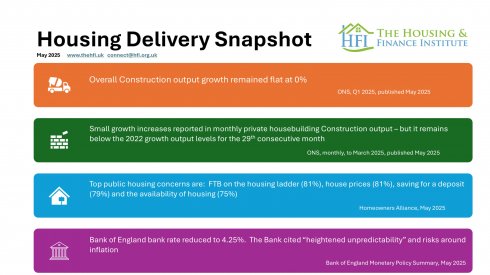

May 2025 Housing Delivery Snapshot

March 2025 Housing Delivery Snapshot

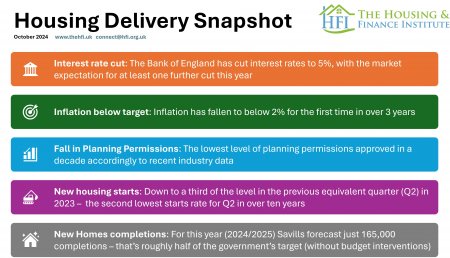

January 2025 Housing Delivery Snapshot

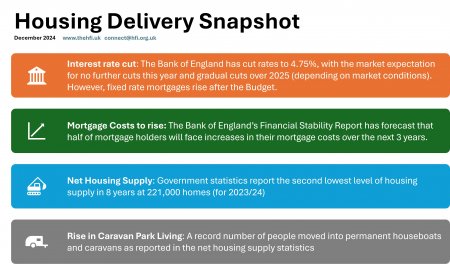

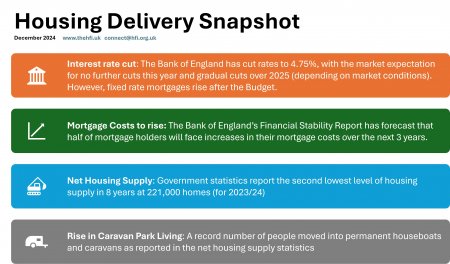

December 2024