25 APR 2025

The HFI Newsletter: April 2025

The HFI Newsletter: April 2025

Your regular update on housing market delivery and good reads on how to get more done in housing and housing finance

Fixing housing: saying "yes" to building the right homes, in the right places, and getting on with the job

This month's HFI's must read article is from the Institute's co-founder and Leader of Eastleigh Borough Council, Keith House.

In this inspiring article, Keith sets out why and what councils 'can do' to deliver not just the homes, but the places and communities that are right for them. He argues that Councils can and must step into the void of housing delivery and once again take charge of increasing supply and directly intervening in the broken housing market, as they did in the past. He explains that it's a local authority's cause to improve life-changes right up there with tackling climate change and moving health policy to prevention from cure. Yet still so many believe councils do not have the power to act. But they do. Councils can and should own housing as an issue around planning, intervention and supply.

Read on to answer the question – can Councils fix housing? (yes they can):

Record Rent Rises hit the North-East

As the ONS released private rent statistics in April, annual rental growth rate for the North-East region hit a record high at 9.4%, higher than London.

The drivers for investment in the North-East are clear – lower property prices and high yields. For example, recent research on HMO (Houses in Multiple Occupation) found that the North-East total investment return on investment of 37% and the highest rental yield at 15.4% as against a 10.4% national yield average. London remains the greater market concentration of HMOs, with over one-fifth of the overall market share.

This is echoed in recent research by specialist mortgage lender Paragon Bank which also found that average rental yields on private rented property had hit a 13 year high (since March 2011) – with Wales having the highest rental yields followed by the North-East.

Mortgage boost for First-Time Buyers

Latest mortgage figures from the Bank of England reported the highest share of mortgages for house purchases for owner occupiers since 2007. Overall, the share of Buy-to-Let mortgages continued to increase against owner occupation mortgages, at 8.2% of gross mortgage advances.

Planning reforms on track to support the delivery of more homes

The Office for Budget Responsibility have forecast an improved housing delivery outturn following the Government's planning reforms, writing "From a 12-year low in 2025-26, net additions to the UK housing stock are forecast to reach 305,000 a year by the end of the decade. From 2025-26 to 2029-30, we project around 1.3 million cumulative net additions to the housing stock. Of this, we estimate an additional 170,000 are due to the Government's reforms to the National Planning Policy Framework"

The areas of risk and opportunity that the OBR highlight around higher housing delivery include:

- capacity constraints in the housebuilding sector if growing demands on a limited construction workforce hinder housebuilders' ability to deliver a rapid acceleration in the flow of new houses;

- local opposition to reforms that could prevent or delay housebuilding by more than the OBR have assumed, particularly given much of the additional development in the next five years is assumed to take place on current green belt land;

- conversely, growing economies of scale and greater adoption of modular construction methods may enable sustained improvements in the sector's efficiency and its capacity to build houses.

Get in Touch

The HFI's purpose is to support increased housing supply, back councils and businesses working together to build more homes and promote new ways to finance housing delivery. Do get in touch at connect@hfi.org.uk if you would like to share ideas and suggestions on building the homes our country needs.

Best regards,

Natalie Elphicke Ross

Head of Housing Delivery

natalie@hfi.org.uk

www.thehfi.uk

About the HFI

The Housing and Finance Institute works with industry and public sector partners to:

- increase housing supply;

- encourage councils and businesses to work together to build more homes;

- promote new ways of financing and delivering the new homes that the UK needs.

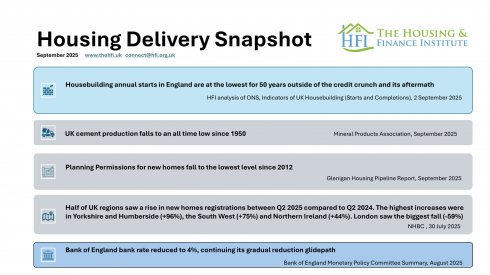

September 2025 Housing Delivery Snapshot

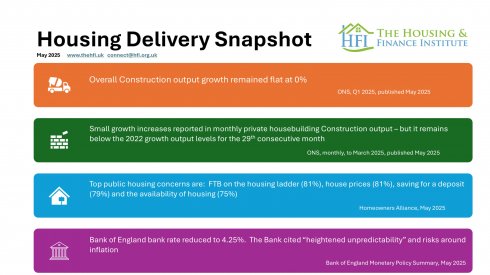

May 2025 Housing Delivery Snapshot

March 2025 Housing Delivery Snapshot

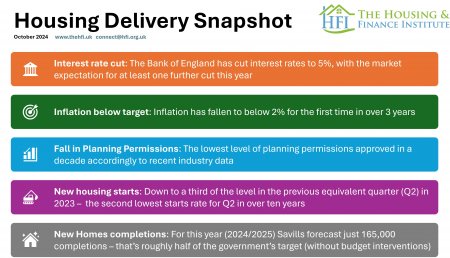

January 2025 Housing Delivery Snapshot

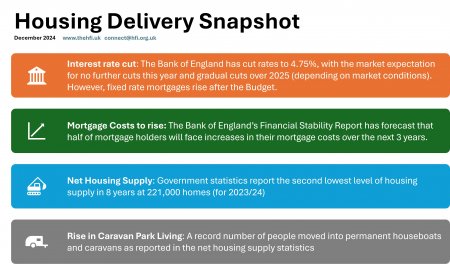

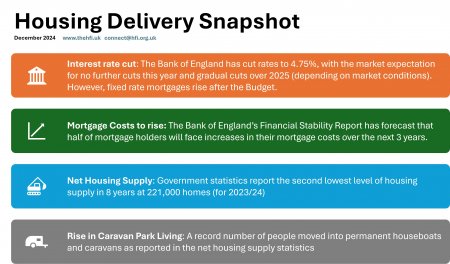

December 2024